SECURITIZATION

(March 2019)

One method for addressing the

management of complex risk is to gain greater, direct access to the

international capital market. An increasingly popular way to do so is called

securitization, which refers to the process of converting non-liquid assets

into market-acceptable securities. The property that undergoes this financial

transformation is called a securitized asset. Many types of property, both

tangible and intangible, may be converted into securitized assets including:

- Commercial structures

- Portfolio of mortgage loans

Note: This asset’s use is likely to be

substantially reduced and highly scrutinized due to its contribution to the

global financial crises that involved the abusive practice of securitizing

tranches of sub-prime home mortgages.

- Business property

- Portfolio of securities

- Heavy duty equipment

- Commercial vehicles

- Copyrights

- Commercial loans

- Receivables

- Rental activities

Securitization Benefits

The originator firm (see definition

below) may benefit from asset securitization in several ways. The benefits

associated for a firm’s decision to securitize a given asset depend upon the

applicable contracts arranged in order to complete the process. Entities that

use securitization usually experience a higher level of liquidity, a reduced

risk of owner-related liability, improved cash flow and cost savings for

capital funding. Investors are attracted to these securities because they

represent a chance to diversify their investment dollars and the interest rate

payments are usually high.

Related Article: Convergence

Products

Note: See the portion of the article and diagram below

concerning insurance-linked securities.

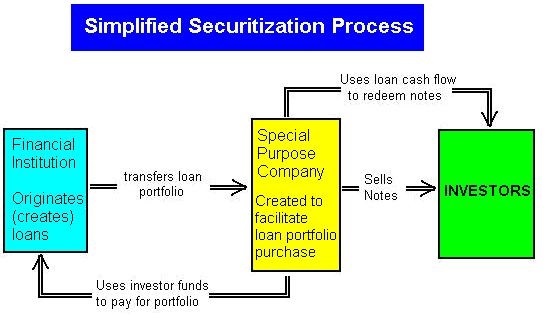

Securitization Process

Securitization begins by selecting the

property intended to go through the process. While many types of assets may be

used, they have the following characteristics in common:

- The assets must belong to the entity that wants

those assets securitized

|

Example: Skynd Animals, Inc. decides

to look into securitization: Scenario 1: Skynd

decides to securitize its inventory of stored minks and other furs. They make

other plans when their attorney reminds them that the furs belong to their

various customers and they can’t securitize what they do not own. Scenario 2: Skynd

decides to securitize its book of storage rents due from their customers’

annual storage fee agreements. They proceed when their attorney advises that

they own and control their rental fee receivables. |

|

- The assets must be homogenous

|

Example: Pies A-Burning Ltd. wants to securitize some assets.

They are foiled in their attempt when it is known they want to, as a package,

securitize their book of loans, their inventory of machinery and their rental

properties. |

|

- They must be legally separated from their other

assets

Once a pool of eligible assets is

created, their ownership must be transferred to an entity, called a special

purpose vehicle (SPV) that is independent from the originator firm. Generally,

a separate trust is created for this purpose. The originator firm sells the

selected, pooled assets to the SPV and it becomes the legal owner of the

property. Then, the SPV markets securities to outside investors. The securities

sale is backed by the very assets entrusted to the SPV. It is when the assets

are used as collateral that they officially are considered “securitized.” Prior

to that point, they are merely segregated trust property.

|

|

Securitization Risks

A firm that goes through the process

faces a set of associated exposures including:

- Credit risk

- Prepayment risk

- Interest rate risk

- Operational risk

- Funding risk

In addition, firms that securitize

assets must be sure that those assets are reported properly for accounting

purposes. Often such assets may be treated as sales, but the details of a given

agreement may create separate obligations and trigger less preferential tax

treatment.

A major problem is that securitization

can involve a substantial moral hazard due to various actors having roles that

overlapped when they should have been separate. The overlap allowed a high

degree of self-interest, especially with regard to the quality

(creditworthiness) of the underlying assets.

Definitions

Various terms are associated with the

above process, including the following:

Asset-backed Security

– any asset that is used as collateral in support of securities sold to

investors for that asset.

Conduit

– a trust

established for the single purpose of receiving a given firm’s assets and

issuing various types of debt, backed by those assets.

Depositor

– a limited purpose

entity which initially accepts assets intended for securitization from an

originator firm and then transfers the assets to an SPV (also known as Special

Purpose Entity).

Marketable

Security – an item that

may be freely traded among interested parties (investors) according to an

agreed, generally fluctuating price.

Multi-Seller

Conduit – a trust that

receives assets from more than one originating firm and issues various types of

debt, backed by those assets. Each originating firm’s assets are kept in

separate, securitized accounts.

Originator

Firm – the entity

that is the original owner of the securitized property. This firm makes the

initial decision to go through the asset securitization process.

Securitized

Asset – any property

that, via a financial transaction, is transformed into a marketable security.

Securitization

Vehicle – see special

purpose vehicle.

Special

Purpose Vehicle – also known as

Special Purpose Entity, refers to the entity (typically an association,

corporation partnership or a trust) that acquires the ownership rights to

property that is undergoing securitization. It is the SPV that sells securities

that are backed by the income flow generated by the securitized property.

Sponsor – another term for originator firm.

SPV – see special purpose vehicle